- Australian Tin Mining adds second coking coal project to its portfolio

- ‘Mackenzie and Ashford will provide commodity diversification and growth opportunity’

- ASX coking coal stocks guide: Best positioned stocks

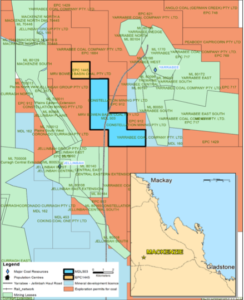

Australian Tin Mining (ASX:ANW) has added a second coking coal project to its portfolio with the acquisition of the Mackenzie coal project in Queensland’s Bowen basin coalfield.

Mackenzie is within a patchwork of coal tenements that includes Jellinbah Group’s flagship mine and Yancoal Australia’s (ASX:YAL) Yarrabee mine that mostly produce low volatile, pulverised coal injection (PCI) coal – a grade of metallurgical coal that is used in steel plants.

“As global steel production rises to meet post-COVID demand, and given there is no commercial substitute for metallurgical coal in the production of steel, global demand for metallurgical coal will increase,” said director Nicholas Mather.

The company purchased the Mackenzie project from Resources and Energy Investments (REI), which acquired the project from the liquidators of previous owner MRV Bowen Basin Coal Pty.

Mackenzie has a JORC coal resource of 138 million tonnes of low volatile PCI coal and a previous owner of the tenements, Moreton Resources, said the resource contains semi-soft metallurgical coal and low volatile PCI coal.

Australian Tin Mining has provided $1m of its shares, $100,000 in cash, and a $1 per tonne coal royalty or 1 per cent of gross proceeds of any coal sold payable to REI for the project.

China’s demand for Australian coking coal is expected to lift over the next couple of years.

Ashford coking coal project added in July

In July, the company announced it was taking over Laneway Resources’ (ASX:LNY) Ashford coking coal project in northern NSW approximately 50km west of its Taronga tin project.

Under the deal, Laneway Resources received a 20 per cent shareholding in Australian Tin Mining, $7m in cash or $2m cash and $5m worth of ATM shares, and a 50c per tonne royalty for each tonne of coal mined at the Ashford project.

The Ashford project has a resource of 14.8 million tonnes that can qualify as semi-hard coking coal, of which 9.4 million tonnes is accessible through open cut mining.

A proposed Inland Rail project is located 100km east of the Ashford project that will connect to ports with coal export facilities in Brisbane and Newcastle.

“Mackenzie and Ashford will provide commodity diversification and growth opportunity for Australian Tin Mining to create shareholder value…” said Mather.

Diversification part of new strategy for Aus Tin Mining

Australian Tin Mining has unveiled a new four-point strategy aimed at improving shareholder value.

This includes diversifying its commodity base, simplifying its project portfolio, bolstering its balance sheet and leveraging its existing assets such as its Taronga tin-silver-copper asset.

Key projects for Australian Tin Mining are its Taronga tin project in northern NSW, Mt Cobalt and Pembroke projects in Queensland, and Lachlan Fold copper-gold project.

At the peak of the cobalt-boom in 2018, drilling results at Mt Cobalt propelled Australian Tin Mining to a stock market value of $70m for a brief period.

Taronga tin deposit has the fifth largest undeveloped tin reserve in the world, containing 57,000 tonnes of tin and 26,000 tonnes of copper, for which a pre-feasibility study has been completed.

In a presentation the company said tin was identified by Rio Tinto as “the metal most impacted by new technologies” and its market is in deficit currently.

Queensland coal producer extends life of processing contracts

Meanwhile, Brisbane-based privately-owned coal producer QCoal has awarded two contract extensions for the operation of its Sonoma and Byerwen coal processing plants worth $166m.

The contracts were awarded to CIMIC (ASX:CIM) subsidiary, minerals processing company Sedgman, and replace and extend existing agreements.

“Sedgman’s expertise in minerals processing and focus on maximum resource recovery will help drive even greater efficiencies at these mines,” CIMIC Group chief executive, Juan Santamaria said.

Sedgman carried out the engineering design, construction and commissioning of Sonoma’s coal handling and preparation plant in 2007.

The company did the engineering and construction work for Byerwen’s train loadout facility and processing plant in 2017, and commissioned the duplication of its processing plant in 2018.