China has ordered traders to stop purchasing at least seven categories of Australian commodities, including coal, barley, copper ore and concentrate, sugar, timber, wine and lobster, Bloomberg reported.

Beijing and Canberra have been locked in a geopolitical dispute since April after Australia pushed for an international inquiry into the origins of the covid-19 pandemic.

Reports by the South China Morning Post suggest that copper and sugar exports from Australia into China will be halted, after the country banned the import of timber from Queensland and barley shipments from an Australian grain exporter.

Australian rock lobster shipments were also delayed in Shanghai on the weekend.

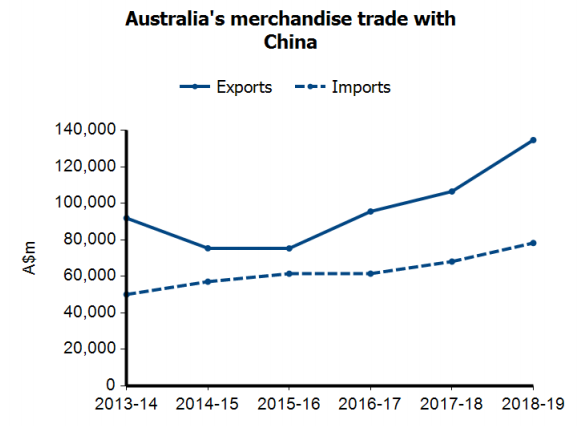

China is Australia’s most important and biggest trading partner. The two-way trade between the countries is worth around A$240 billion ($171 billion), while China buys around 39% of Australia’s merchandise exports.

“China seems determined to punish Australia and make it an example to other countries,” Richard McGregor, a senior fellow at Sydney-based think tank the Lowy Institute told Bloomberg.

“They want to show there’s a cost for political disagreements.”

Australia is China’s top supplier of iron ore and coking coal, the two main ingredients used to make steel, while also being a major provider of LNG and thermal coal, used predominantly in power stations.

BHP confirmed it received deferment requests from Chinese coal customers.

Iron ore, Australia’s biggest export to China, won’t be included in the halt, say people familiar with the situation. Australia exported about 78 million tonnes in October, according to Refinitiv. China buys over 80% of Australia’s production.

Australian copper miner Sandfire on Tuesday called the reports “media speculation” and said its DeGrussa and Monty mines, two of the Asia-Pacific region’s premier, high-grade copper mines, have continued to operate at full production rates into the December 2020 Quarter and production guidance for FY2021 is maintained.