January 04, 2022

As we kickoff trading in 2022, the commodities bull market is climbing a wall of worry, plus more surprises.

Commodities Bull Climbing A Wall Of Worry

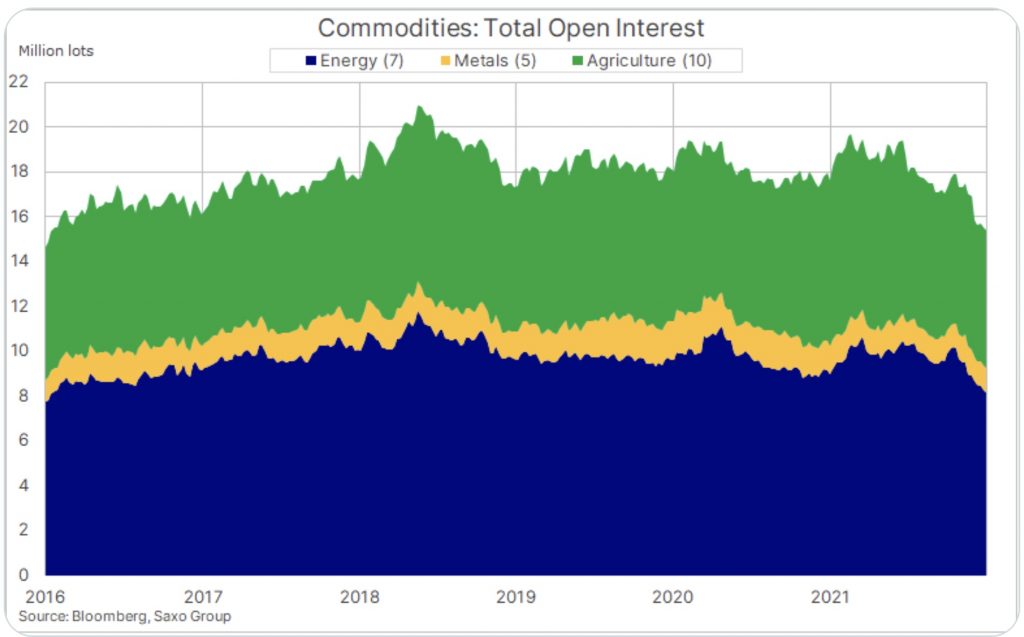

January 4 (King World News) – Ole Hansen, Head of Commodity Strategy at Saxo Bank: After the strongest year for commodities since 2001 the open interest across 22 major futures contracts ended 2021 at 15.4 million lots, a five-year low. Especially the energy and agriculture sectors saw fading interest into yearend.

CONTRARIAN DREAM AS NOBODY BELIEVES:

Open Interest (Longs) In Commodities Hits 5 Year Low!

Bonds On The Move

Peter Boockvar: Yesterday’s biggest jump in the 10 year yield since mid November didn’t happen in a vacuum. Of the 12 bps increase, 5 came from inflation expectations and I’m guessing the belief on the balance is the realization that for most, omicron is just a cold and case numbers should be rolling back down again within a month. On the Wednesday before Thanksgiving, before most of us heard of omicron that Friday, the 10 yr yield was at 1.64% vs exactly 1.64% today. The 10 yr inflation breakeven on that Wednesday was 2.62% vs 2.65% today. What’s changed from that Wednesday in November is the rise in short end rates with the 2 yr at .78% vs .64% then as the Fed has shifted as we know. Also, the 9 bps rise in the 5 yr yesterday was just about fully matched by the 9 bps increase in inflation breakevens which is back to 3% for the 1st time since that Wednesday when it was at 3.06% before a 10 bp drop that omicron Friday.

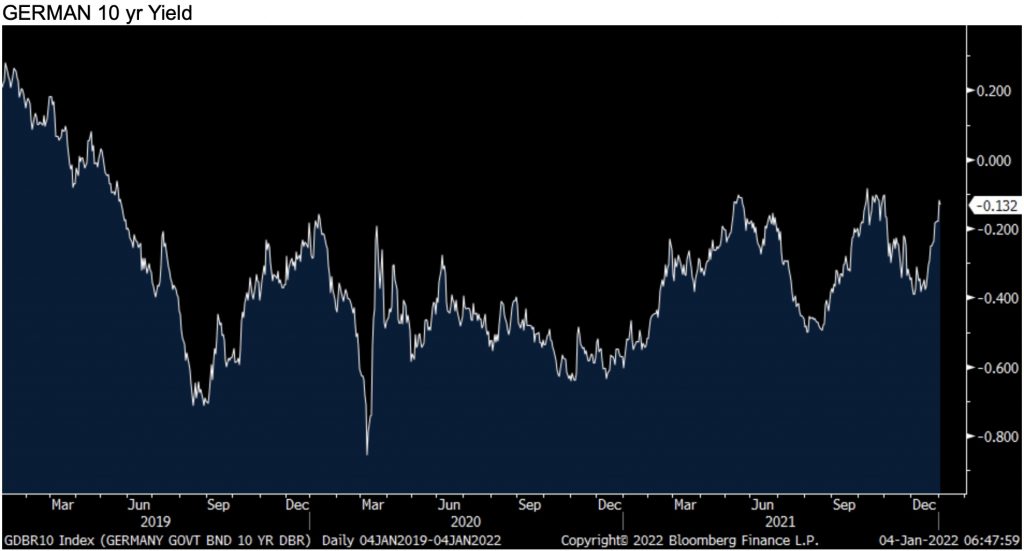

Also, the selloff in European bonds were a factor here too. I said many times that you can analyze US growth and inflation rates all you want but where European yields go will be a big influence on ours. The German 10 yr bund yield yesterday rose 6 bps to -.12% which compares to -.37% just two weeks ago. That yield is down 1.5 bps today. If you still must buy that bund having to give 13.5 bps each year, it compares with 10 yr inflation expectations in Germany of 1.81%.

In the financing environment right now if one is not a small business looking for a bank loan (it’s still tough and a personal guarantee is demanded) and instead is in search of VC or PE money, all you need still is being able to breathe and have a power point presentation. While I wish them all the best, I read in yesterday’s WSJ about the company Colossal who back in September raised $16mm, double what they were looking for. What do they do? They want to resurrect the wooly mammoth in a very Jurassic Park sort of way. They want to genetically modify the Asian elephant to do this in what they refer to as de-extinction. Here is their website if interested, https://colossal.com/mammoth/ and the mammoth was considered an extinct species in 1796 according to Wikipedia. I hope they are successful as this would be interesting to see…

To find out which silver company just made a major acquisition that will

quadruple their production click here or on the image below

The Caixin December Chinese manufacturing index rose 1 pt m/o/m to 50.9 and that was better than the estimate of little change to 50 and vs 50.6 in October. Caixin said “Firms signaled the strongest increase in output for a year amid a renewed uptick in total sales. However, foreign demand remained lackluster, with export orders broadly stagnant. Improved demand prompted a fresh rise in purchasing activity, but backlogs rose again amid a further drop in staffing levels. Supplier performance meanwhile deteriorated at a softer pace, and inflationary pressures weakened. Notably, average input costs rose at the slowest pace for 19 months.” Lower steel prices were specifically cited but I’m sure lower iron ore prices too were a factor, notwithstanding the recent jump.

As for industrial commodity prices generally, the CRB raw industrials index yesterday closed within less than 1% of a record high.

The ISM bottom line was this, “The US manufacturing sector remains in a demand drive, supply chain constrained environment, with indications of improvements in labor resources and supplier delivery performance. Shortages of critical lowest tier materials, high commodity prices and difficulties in transporting products continue to plague reliable consumption. Coronavirus pandemic related global issues – worker absenteeism, short term shutdowns due to parts shortages, employee turnover and overseas supply chain problems – continue to impact manufacturing.”

With respect to the supply delivery side, “Transportation networks, a harbinger of future supplier delivery performance, are still performing erratically; however, there are signs of improvement.”

My bottom line is this, understanding that this data only measures the direction of change, not the degree, we have hopefully seen the worst of the supply challenges, especially with the holidays now over (although we still have the delivery crunch ahead of Chinese New Yr) and maybe also a peak in the rate of change with commodity prices. Although I don’t believe we’ve seen the absolute peak in commodity prices as I still think they go higher, notwithstanding any corrections this year…

Keith Neumeyer Just Predicted $100+ Silver And $3,000 Gold! TO LISTEN CLICK HERE OR ON THE IMAGE BELOW.

An Uncertain 2022

I do admit that I’m really uncertain how 2022 plays out economically with so many moving parts. While I’m confident that inflation will remain persistent all year, though with a slower rate of change than in 2021, we’ll have to see to what extent higher wages offsets that and can companies maintain such high profit margins. What will be the fiscal hangover as while Congress will no doubt come up with another spending package ahead of the midterms, it will be much less than that seen in 2020 and 2021? And lastly, I have no idea how this inventory situation is going to play out in terms of where it normalizes at. How much in goods have companies double and triple ordered? How much in goods is still needed just to get back to normal inventory levels?

Anyone speaking with confidence on how these issues play out have a much better crystal ball than I do. The only thing I’m confident in is that monetary tightening as it plays out will not be painless and inflation will remain sustainable at levels well above where they were pre Covid.

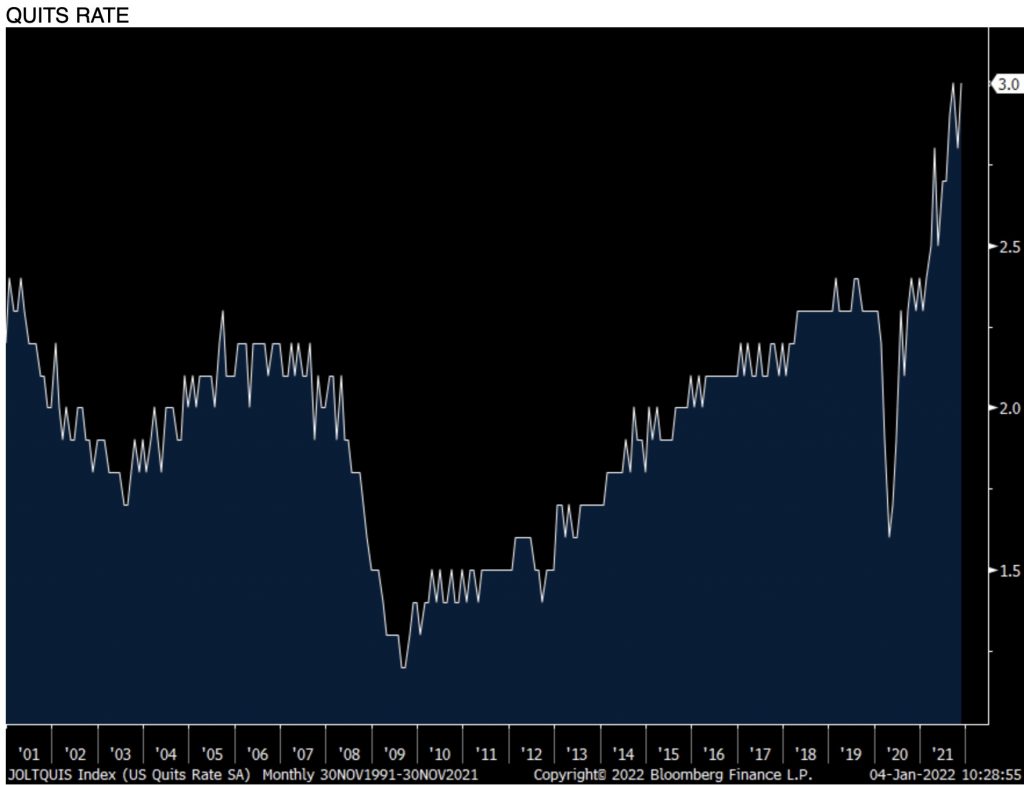

Somewhat dated, in November we saw 10.56mm job openings vs 11.1mm in October. While below the 11mm estimate, it still is very high and remains well above the number of unemployed at 6.88mm in November. While omicron messes up the situation, it’s clear that demand for labor is still far outpacing supply and why wages will continue higher as leverage shifts to employees. The quits rate went back to its record high at 3% with the absolute number of quitters also going to a record high of 4.5mm people.

To hear Robert Arnott discuss what surprises to expect in 2022 as well as what to expect in global markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the setup for the gold and silver markets in 2022 CLICK HERE OR ON THE IMAGE BELOW.

Setup As We Kickoff 2022

ALSO RELEASED: Rob Arnott On The Bang Moment And The Coming Great Awakening CLICK HERE TO READ.

ALSO RELEASED: Uncharted Waters As We Kickoff 2022 But There Will Be A Big Test In The First Half Of The Year CLICK HERE TO READ.

ALSO RELEASED: Here Is The Setup As We Kickoff 2022 CLICK HERE TO READ.

© 2022 by King World News®. All Rights Reserved.