BY CAPITALIST EXPLOITS

FRIDAY, JAN 07, 2022 – 12:01

WATCH COPPER!

Leftist Boric wins Chile presidential election after far-right rival Kast concedes defeat

Chilean leftist Gabriel Boric won the country’s presidential runoff election on Sunday, capping a major revival for the country’s progressive left that has been on the rise since widespread protests roiled the Andean country two years ago.

It’s too early to know what this crowd of thugs decide to do, but certainly if their ideology is anything to go by, then we can expect a lot of buzzwords such as “equality,” “fairness,” and of course higher taxes, and if it really gets out of hand, then nationalisation of resources.

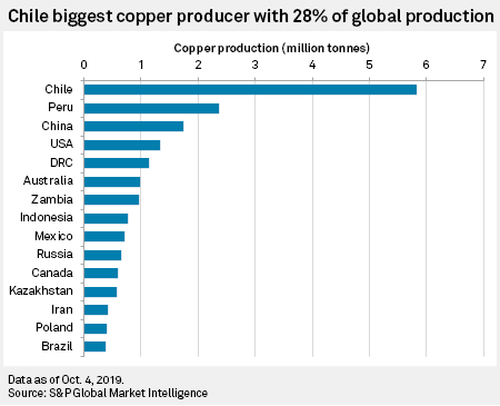

It is hard to handicap the global copper market without considering Chile. Take a look.

Copper prices have had a good run for us so far.

The incoming communists’ controversial tax reform bill is a doozy. How it doesn’t put a quarter of Chilean copper output at risk I don’t know.

Under the proposed change, the ‘royalty’ rate — the amount taken by the government — would be based on “output rather than profits” and could rise to 75% when copper prices exceed $4 per pound. So in an environment where stagflation is taking hold aggressively and miners’ operational costs rise (everything is costing more) there is no ability to offset these costs because the tax is purely on “output”. Holy shit!

Manuel Viera, president of the Chilean Mining Chamber, was blunt and honest in his assessment:

Many low-grade operations will be put out of businesses, destroying jobs.

Don’t look now but Chile is also home to the world’s largest known lithium reserves.

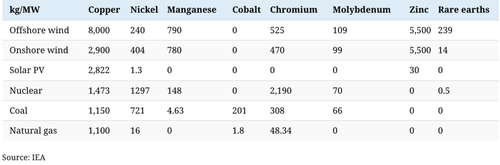

It’s a good thing we’re in a “renewable revolution,” which requires a heck of a lot more of what Chile produces.

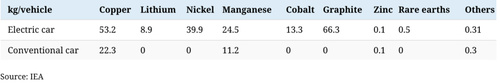

In particular, a typical electric car requires six times the minerals of a conventional car, and an onshore wind farm requires nine times more minerals than a gas-fired power plant with a similar output. Electricity grids need massive amounts of copper and aluminum, with copper being a keystone for all electricity-related technologies.

So we remain long copper via FCX, which has minimal exposure to Chile. Now with an escalating risk profile for copper assets in Chile going forward, FCX looks sexier than ever to us.

FCX’s only exposure to Chile is its 51% interest in El Abra, an open-pit copper mining complex. El Abra’s copper production totaled 200 million pounds in 2018, and FCX’s share of its production capacity accounts for about 2% of FCX’s copper equivalent total capacity. In other words, it’s rather meaningless.

The market hasn’t priced this as far as we can tell though Chilean copper assets sold off hard on the announcement. That makes sense but there are two things going on here.

One is that they sold off due to the market pricing those assets as having problems.

Those problems will likely cause less supply so the question is then where is the supply going to come from?

So I don’t know how long we wait but inevitably folks will start looking about to find who exactly is going to bring home the bacon copper.

How Our Fund Is Playing 2022 And Beyond

- Copper – Copper prices have to rise to address a huge supply deficit looming on the horizon.

- Shipping – Shipping is vital for the functioning of the modern world, yet is priced for bankruptcy.

- Eastern Europe – Position for the long-term trend of capital moving from the West to the East with Polish and Russian equities markets.

- US Dollar – We’re bearish all paper currencies, but believe that the USD will outperform all others.

- Base Metals – Clean energy targets require more battery metals than existing global supply.

- Off Shore Oil & Gas – Offshore oil investment has been smashed, yet consumption continues to grow.

- Rare Earth Metals – A play on geopolitics and a cycle that should see a repricing of these commodities.

- Russion Oil & Gas – Virtue signaling abandonment of fossil fuels led by Western oil co’s means Russia is taking up the slack.

- Uranium – The looming supply deficit promises to pay handsomely when the market inevitably reprices.

- Gold – Gold sees the perfect storm; the turn of a cycle, supply issues and lack of faith in sovereign currency.

- Coal – Modern society is dependent on coal, with supply continually growing. Is there a more hated investment?

- Personal Defense – Order is breaking down in the US, and the unrest is giving us an opportunity to position for asymmetry.

- Agriculture – Lockdowns and monetary stimulus have ensured food prices will rise, providing deep value.

- Natural Gas – Supply and demand dynamics coupled with dependency from the US provides a great opportunity.

- Plus much much more…