Governments around the world have launched economic recovery packages in response to the recession brought on by the COVID-19 pandemic. Two key themes feature prominently: investments in digitalisation and green technologies. Both China and the EU have established reactivation plans supporting 5G telecommunications networks, big data, and artificial intelligence (Meinhardt 2020, European Council 2020). The EU has further committed its recovery to moving the region towards carbon neutrality by 2050, proposing a massive expansion of the electric car market and related charging infrastructure (European Commission 2020). These demand drivers are expected to accelerate the arrival of the age of copper (Taylor 2020). The red metal conducts both heat and electricity, and is a key input for global manufacturing, electrical equipment, industrial machinery, and construction. China’s post-pandemic rebound has already translated into higher orders. In June 2020, China recorded the highest ever monthly imports of copper (Reuters 2020). Are copper producers prepared to leverage this new era for their development?

These trillion-dollar, multi-year recovery plans require significant quantities of copper. This will accelerate the demand for the metal which has picked up steadily since 2016. This rise in demand is thanks in part to copper’s central role in the digital and green economy of the future. Clean energy is the fastest growing segment to support electrification, with solar panels and wind turbines requiring some 12 times more copper than previous generation methods (Copper Development Association 2020a). Further, electric vehicles use four times the amount of copper used in internal combustion engines (Glencore 2017). A Chinese national 5G network will require some 72,000 tons of copper (Mills 2020). COVID-19 has also brought copper to the forefront of the healthcare industry due to its antimicrobial properties, adding entirely new sources of demand (Copper Development Association 2020b). Even before the pandemic, it was estimated that the sector would drive one million metric tonnes of demand over the next 20 years (Morrison 2020). While demand in 2020 may yet fluctuate (as countries respond to the pandemic), the fundamentals of copper demand have changed for the better (Hall 2020, Jacks and Stuermer 2018).

This boost in future demand is taking place against a backdrop of tightening supply in a globally concentrated industry, contributing to a likely copper deficit (Mining.com 2019). Five countries – Chile, Peru, Indonesia, Australia, and Canada – export three quarters of traded copper concentrate. The two ‘Latin leaders’ – Chile and Peru – are by far the most important in terms of meeting the new demand since they account for close to half of the world’s supply. Chile is home to both the world’s biggest copper mine (Escondida) and the world’s single largest copper company (the state-owned CODELCO) (Chen 2019). This company alone accounts for 10% of the world’s copper.

Stung by end of the ‘supercycle’ in 2012, CODELCO and other leading miners have operated conservatively. They have focused on consolidating their high-value assets, cutting costs, and boosting productivity. They have also focused on divesting from low-grade projects and limiting exploration and new project development. There are currently very few new projects set to come into operation before 2023. COVID-19 has brought the construction of most of these new projects to a halt. In Chile, CODELCO stopped the underground expansion of its two largest copper mines (El Teniente and Chuquicamata), while Teck Resources’ Quebrada Blanca 2 announced a six-month delay as it sought to protect its 15,000 strong workforce (Reuters 2020b, Fundacion Terram 2020, Jamasmie 2020). Similarly, Peru’s largest new project, Anglo American’s Quellaveco, was brought to a standstill for months.

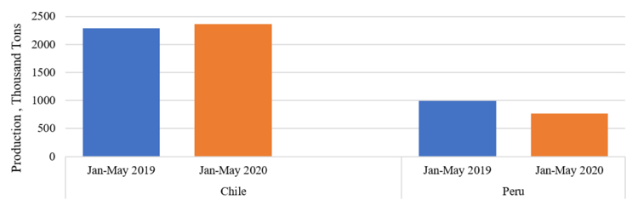

The shutdown of future projects exacerbates the impact of slowdowns in operating mines as a result of the pandemic. Between January and May 2020, Peru’s copper output fell by 23% (year-on-year), as all of its major mines went into care and maintenance, and 75% of its workforce went home in a nationwide quarantine.1 While some employees went back to work by the end of July, output was still below 80%. Peru (the world’s second largest producer) estimates a 20% decline in exports for 2020 (Aquino 2020). While there are concerns about Chilean producers facing similar crises,2 output to date has remained steady with a 3% (year-on-year) increase (Figure 1) (Comision Chilena del Cobre 2020). Through the combined effect of shutting down existing operations and pausing new ones, COVID-19 has pushed back the delivery of thousands of tons of copper, just at a time when demand is beginning to pick up. Despite the global economic contraction, in July 2020 copper futures hit their highest level in two years (at $2.97 per lb) as Europe announced its recovery plans (Els 2020).

Figure 1 Copper production in January to May 2019 versus 2020 (thousands of tonnes)

Source: CoChilco and Banco Central de Peru.

Forecasted additional demand for the red metal represents an important opportunity for major producing countries to generate more value around copper production

While copper directly contributes significantly to host-economies (it accounts for 50% of Chilean exports, 30% of Peru’s, and approximately 10% of fiscal revenue), even greater spillovers can be harnessed (Cochilco 2020). To some extent, mines have operated in isolation from their host economies. In particular, developing countries have struggled to increase the benefits from their engagement in the value chain (De Haas and Poelhekke 2016). Emphasis is often placed on increasing value addition through greater industrialisation of raw materials. Copper producers, however, have shown uneven success in generating shared value around domestic metal processing. For example, returns on copper concentrate smelting remain relatively low, as a result of significant global processing capacity. Further, refining encompasses significant environmental impacts. How to generate more value around mining activities remains a tantalising question for industry and policymakers, as well as for civil society stakeholders. This is especially pressing for those wondering whether the benefits outweigh the social and environmental impacts and risks associated with copper mining.

In recent years, multiple experiences have shown that greater value capture may take place through the development of strong backward linkages to the value chain (Katz and Pietrobelli 2018). This can be achieved through localising the supply base in the host economy. The Chilean copper mining sector procures approximately $12 billion on goods and services annually,3 while Peru’s miners spend $9 billion (INEI 2019). Currently, much of this is spent on foreign goods and services due to limited capabilities and opportunities for local suppliers. Yet, ranging from low-value, simple options such as protective gear and grinding balls to excavators and highly complex engineering services, this industry offers a wide set of opportunities for local suppliers to participate. Australia, for example, has successfully tapped into this GVC upgrading option. It has developed a robust set of METS (mining equipment, technology and services) suppliers, investing $2.7 billion in research and development.4 Not only does this serve domestic mining operations, it also helps to achieve export volumes of approximately $10 billion. However, most producing countries in the developing world lag behind in this area. In the past five years, Chile has made some progress, launching the Alta Ley programme.5 Similarly, Peru has recently launched a mining technological roadmap (but with limited impact to date, considering the sector´s potential and stakeholder expectations) (Bamber and Fernandez-Stark forthcoming).

In this ‘new age of copper’, producer countries need to do better. Mining value chains can help them achieve ambitious innovation, sustainability, and inclusiveness goals. Their development requires decisive and coordinated action from diverse public and private sector stakeholders. First, national mining innovation systems must be geared towards supporting existing (and fostering new) competitive suppliers, as well as creating conditions for local players to access industry opportunities. Open innovation platforms can help bridge market failures and information asymmetries (Bnamericas 2019). Second, as the backbone of the future green economy, copper extraction itself has to become more sustainable, reducing its greenhouse gas emissions and water usage.6 It is also essential to obtain and maintain social licenses to mine, and to respond to increasingly sustainability-minded customers within the value chain. The industry is already actively seeking to adopt zero-emissions, waterless, and desalinisation solutions within its operations (Leotaud 2020, InvestChile 2019).7 Third, it needs to be inclusive – both from a gender perspective and in terms of engagements with local communities (Fernandez-Stark et al. 2019). Generating shared value necessarily means increasing participation from all key stakeholders, as well as effectively leveraging local human capital. It is not just good practice, it is good business (Doku 2019).

Economically, Latin America has been hit extremely hard by the COVID-19 pandemic.8 The economic reactivation plans of China and the EU can be leveraged to support the economic recovery of the region through their demand for copper. It is now up to these countries to seize the moment and make the most of the opportunity.