The gold price rallied again on Thursday as investors seek a store of value after the Fed said it’s pumping another $2.3 trillion in the US economy to stave off depression.

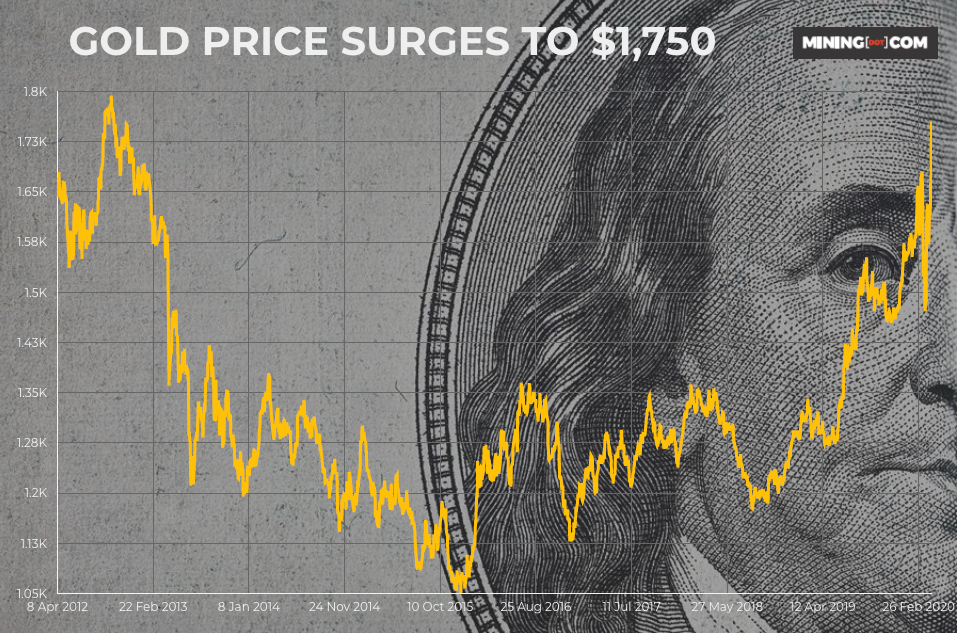

On the Comex market in New York, gold for delivery in June, the most active contract, jumped to the highest since November 2012 at $1,754.50 an ounce in afternoon trade, up just over $70 an ounce, or 4.2% compared to Wednesday’s close.

Fed Chairman Jerome Powell said that the bank was committed to use its powers “forcefully, pro-actively, and aggressively until” the US economy is “solidly on the road to recovery.”

Powell’s comments in a prepared speech delivered virtually followed data showing jobless claims in the US surging by more than six million for the second week in a row, prompting fears that unemployment could reach more than 15%.

Last month, Goldman Sachs said inflationary concerns triggered by the central bank policy response to the pandemic could send gold to $1,800 an ounce as the currency of last resort.

“We believe physical inflationary concerns with the dollar starting near an all-time high will for once dominate financial asset inflation that was a feature of the past decade.”