Central Iron Ore (CVE:CIO) has had a rough three months with its share price down 33%. We, however decided to study the company’s financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it’s worth paying close attention. Specifically, we decided to study Central Iron Ore’s ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Central Iron Ore is:

4.8% = AU$102k ÷ AU$2.1m (Based on the trailing twelve months to June 2020).

The ‘return’ refers to a company’s earnings over the last year. So, this means that for every CA$1 of its shareholder’s investments, the company generates a profit of CA$0.05.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or “retains”, and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don’t have the same features.

Central Iron Ore’s Earnings Growth And 4.8% ROE

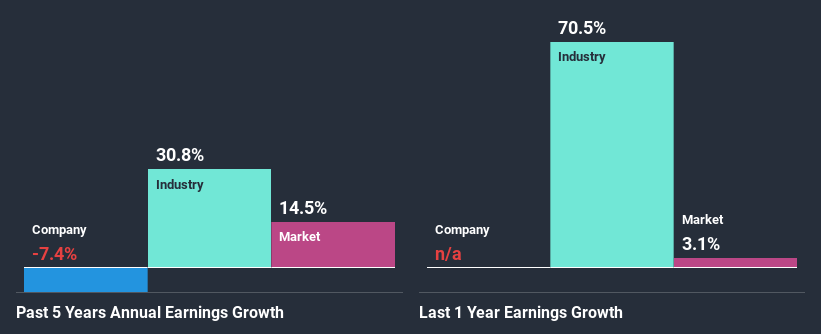

When you first look at it, Central Iron Ore’s ROE doesn’t look that attractive. A quick further study shows that the company’s ROE doesn’t compare favorably to the industry average of 8.1% either. Therefore, it might not be wrong to say that the five year net income decline of 7.4% seen by Central Iron Ore was probably the result of it having a lower ROE. We believe that there also might be other aspects that are negatively influencing the company’s earnings prospects. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

So, as a next step, we compared Central Iron Ore’s performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 31% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is Central Iron Ore fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Central Iron Ore Efficiently Re-investing Its Profits?

Summary

On the whole, we feel that the performance shown by Central Iron Ore can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. Our risks dashboard would have the 4 risks we have identified for Central Iron Ore.