VANCOUVER, British Columbia, Nov. 09, 2020 (GLOBE NEWSWIRE) — Macarthur Minerals Limited (TSX-V: MMS) (ASX: MIO) (OTCQB: MMSDF) (the “Company” or “Macarthur”) is pleased to update shareholders on a very active third quarter 2020. The Company has continued its primary focus on the delivery of key infrastructure and resource outcomes with the ongoing development of the Company’s flagship, Lake Giles Iron Project (“Project”).

KEY THIRD QUARTER HIGHLIGHTS

- Macarthur Minerals successfully completed its Convertible Note offering with a 100 per cent uptake on conversion, announced an equity finance facility available to $20 million and the closing of a $6.25 million private placement.

- The Lake Giles Iron Project continues to advance, with the filing of a NI 43-101 technical report for the project’s magnetite Mineral Resource in October, alongside the completion of conceptual engineering design work for a proposed ‘Helix’ dumper rail unloading solution at the Esperance Port.

- The Company has retained 100 per cent ownership of its Pilbara tenements, following the ending of an earn in agreement for non-iron assets with FE Limited.

- The results of the 2020 Annual General Meeting held on 30 October 2020 demonstrated strong support for the Company’s successes during 2020, with all resolutions passed by an overwhelming majority.

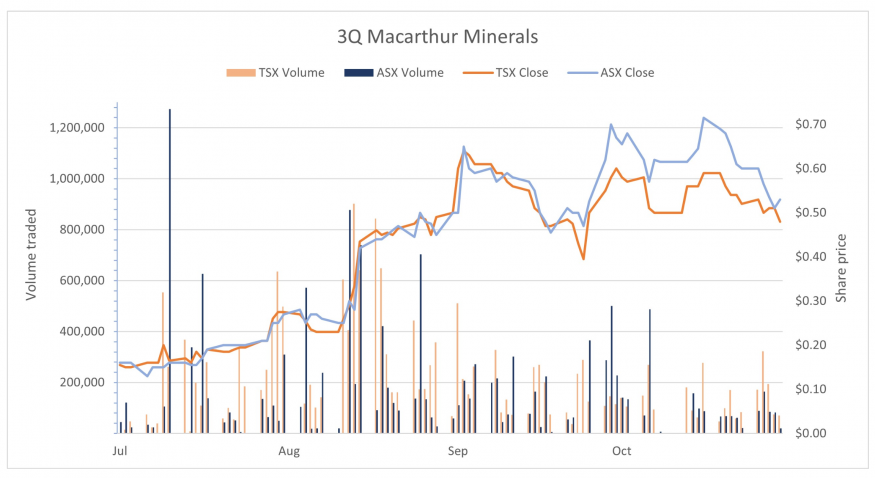

The market continues to respond favourably to the significant progress the Company has made over the past quarter and this has been reflected by increases in both the share price and trading volumes. The Company’s securities traded over the past three months have ranged between C$0.30 and $0.65 on the TSX-V (Canada) and between A$0.30 and $0.72 on the ASX (Australia), breaking through 50 and 200 day moving averages, recording a new 52 week high. Recent trading volumes and share price growth continue to reflect the positive steps taken by Macarthur in advancing its Lake Giles Iron Project.

SUMMARY OF PROGRESS ON IRON ASSETS

MOONSHINE MAGNETITE MINERAL RESOURCE UPGRADE

Macarthur recently announced the updated Mineral Resource estimate for the magnetite deposits at its Lake Giles Iron Project in Western Australia in a news release dated 12 August 2020 (see full release here).

The updated Mineral Resource estimates incorporated the recent infill drilling at the Moonshine magnetite deposits that culminated in an increase in the size of the Moonshine Mineral Resources including resource category upgrades to now include Measured and Indicated resources. Approximately 30% of the Moonshine resource is now classified as Indicated with approximately 7.5% classified in the Measured category. A supporting NI43-101 Technical Report was filed with Canadian regulators on SEDAR at www.sedar.com on 1 October 2020.

Highlights of Mineral Resource estimates:

- Measured resources of 53.9 Mt at 30.8% Fe head grade and 66.0% Fe DTR concentrate grade

- Indicated resources of 218.7 Mt at 27.5% Fe head grade and 66.1% Fe DTR concentrate grade

- Inferred resources of 997.0 Mt at 28.4% Fe head grade and 64.6% Fe DTR concentrate grade

ROUTE TO MARKET

Development of a Commercial Track Access Agreement with Arc Infrastructure

During the second quarter Macarthur received a proposal from Arc Infrastructure (“Arc”) for indicative track access pricing (“Proposal”). The Proposal also provides a clear pathway for the development of a Commercial Track Agreement which will provide sufficient below rail network paths between the planned rail siding and the Port of Esperance. The Proposal also delivers the level of certainty on the below rail component that Macarthur requires to underpin its Feasibility Study (“FS”). Macarthur and Arc will shortly begin the next phase of discussions necessary to complete this essential component of the route to market.

Haul road and rail-siding applications lodged

Macarthur has lodged applications with the WA Department of Mines, Industry, Regulation and Safety (“DMIRS”) to develop a 93-kilometre haul road to a proposed rail siding adjacent to the Perth to Kalgoorlie rail line. The proposed haul road and rail siding will enable the transport of magnetite iron ore from the Lake Giles Iron Project to the proposed new unloading infrastructure at Esperance Port. The proposed rail siding will also have the potential to support early revenue direct shipping ore (“DSO”) mining operations via Kwinana or Esperance ports, subject to port capacity.

Above rail haulage

Macarthur has been engaging with above rail service providers in respect of rail haulage services for its magnetite, as well as opportunities for its hematite iron ore products. The Company has confirmed the availability of required above rail paths for its products and has received indicative pricing. The Company is assessing its above rail options and will advance rail haulage discussions over the coming months.

Further advancement of rail un-loading solution at Esperance

Macarthur has continued to work with RCR MT to develop an engineering solution for rail wagon and unloading infrastructure for the Lake Giles Iron Project at Esperance Port. RCR MT has examined the potential of rail transport and unloading infrastructure that will employ a revolutionary ‘Helix Dumper’ unloading system and Helix Dumper wagons. 3D modelling has been prepared and discussions are now advancing with Southern Ports on the potential for this infrastructure to be developed within Esperance Port.

Macarthur is supportive of this infrastructure being utilised on an ‘open-access’ basis and remains excited by the potential operational efficiencies, additional capacity and revenue potential that this privately funded infrastructure can deliver for the Port of Esperance and to the region. If the rail un-loading solution is given the go-ahead by the Port, then it could also support the establishment of manufacturing jobs to support local construction of the Helix Dumper Wagons in Western Australia.

IRON ORE MARKET

Iron ore prices have continued to remain robust during the quarter, despite the global COVID-19 pandemic.

ANCILLARY IRON PROJECTS

Macarthur also holds three additional iron ore projects in the Yilgarn region of Western Australia through its wholly owned subsidiary Esperance Iron Ore Export Company Pty Ltd. These projects are proximate to Macarthur’s Lake Giles Iron Projects and are adjacent to active and past iron ore mining operations linked to established rail infrastructure to the Port of Experience.

Treppo Iron Project

The Treppo Iron Project comprises one application for an Exploration Licence that is located approximately 30 kilometres West of the Lake Giles Iron Project. Upon grant of this tenement the Company plans to commence exploration including drilling of hematite targets that have been mapped to date. This project is ideally situated in close proximity to the Company’s Lake Giles Iron Project and provides long term optionality in utilising regional infrastructure and allows for fast-tracking of development.

Mt Jackson Iron Projects

The Mt Jackson Iron Project comprises two granted Exploration Licences (E77/2542 and E77/2543) that are located approximately 35 kilometres West-northwest and 38 kilometres Southwest of the Treppo Iron Project. Tenement E77/2542 is located adjacent to the Deception iron ore deposit that is actively mined by Mineral Resources Ltd (“MRL”). Tenement E77/2543 is located adjacent to the J3 iron ore deposit owned by MRL and previously mined by Cliffs Asia Pacific. The Company is currently developing a program of field mapping and rock chip sampling to understand the prospectivity for iron ore across these projects.

EARLY REVENUE IRON ORE OPPORTUNITES

Macarthur continues to assess the potential for opportunities to transition to early revenue-generating DSO iron ore operations. With the current strength and stability of the global iron ore market, Macarthur is examining project opportunities that have potential to generate early revenue flows including a possible acceleration of development of the Company’s Ularring Hematite Project at Lake Giles.

FINANCING

The Company, through its appointed New York corporate advisors EAS Advisors LLC, continues to progress financing and / or strategic partnering discussions in parallel to the Feasibility Study.

The Company recently appointed General Manager, International Sales & Marketing Mr. Jonghyun (Richard) Moon to identify and develop opportunities for strategic partners to invest in the Lake Giles Iron Project. Richard brings over 20 years of experience to the role and previously held roles at Hyundai Steel Company of Australia, Glencore International, and POSCO in international iron ore and commodities sales, as well as marketing and mining investment.

COVID-19 IMPACTS

The Company has continued its highly productive “business as usual” focus over the last quarter. COVID travel restrictions remain fluid within Australia. The changes in travel restrictions may impact upon timing for completion of certain components of the Feasibility Study, but the Feasibility Study is well underway and at this stage Management maintains confidence that any potential for delays can be minimised.

SUMMARY OF NON-CORE ASSETS

In 2018, Macarthur ventured out the majority of its gold and lithium tenements in the Pilbara region of Western Australia to ASX listed Australian explorer, Fe Limited (“FEL”). Fe Limited withdrew from the venture in mid September to focus on its iron ore assets and Macarthur has retained 100% of the tenement areas. Macarthur is currently compiling all of the technical information created on these tenement areas prior to formally seeking new venture partners to further explore these areas.

Hillside tenements

During the quarter, FEL conducted further exploration activities on the Hillside tenements following the drilling program completed in 2019. A Fixed Loop Electromagnetic (FLEM) survey was conducted in July 2020 across several high priority targets generated from the SkyTEM electromagnetic survey in 2018 and drilling in late 2019. The survey data is currently being interpreted and will be made available to prospective joint venture partners

Strelley Gorge & Tambourah tenements

Macarthur holds the Strelley Gorge and Tambourah tenements in the Pilbara region of Western Australia. The Strelley Gorge tenement (E45/4735) is prospective for DSO iron ore and is located immediately adjacent to the Abydos iron ore project that has been mined by Atlas Iron. The Tambourah tenement (E45/5324) is also prospective for iron ore having intersected iron ore in historical drilling by Atlas Iron. The drilling focussed an outcropping BIF prospect in the north of the tenement. Macarthur considers both tenements prospective for iron ore and is seeking interested parties to further explore these assets.

REYNOLDS SPRINGS LITHIUM BRINE PROJECT – NEVADA, USA

Macarthur holds 210 unpatented mining claims covering a total area of 17 square kilometres at its Reynolds Springs Lithium Brine Project in the Railroad Valley, Nevada, USA. Analysis of geochemical soil sampling reported up to 405ppm Li. The project targets lithium brine in a large topographically closed playa basin.

The Company is seeking interested parties to further explore this asset portfolio.

NEXT STEPS

Macarthur will actively advance, with its key partners, its core iron ore assets in Western Australia. This includes advancing negotiations with key stakeholders to finalise the route to market through to Esperance Port, continuing to advance the current Feasibility Study and seek interested parties looking to advance in the short term the hematite, gold and base metals assets held by Macarthur.

The Company will continue to compile the geological data created with its Joint Venture Partner, Fe Limited (ASX:FEL) to advance exploration of its high-quality lithium, gold and base metal tenements in the Pilbara region.

Cameron McCall, President and Executive Chairman of Macarthur Minerals commented:

“The iron ore price has remained strong, despite the COVID-19 pandemic, trading above US$100.00 for 62% iron and this price stability is creating momentum in the global iron ore industry. The high grade 65% Fe market is still commanding a strong premium in the global markets as China continues to seek lower steel industry emissions whilst also optimising its production efficiencies with premium feedstocks of iron ore. The Company’s core focus remains on delivering a high-grade, low-impurity magnetite fines product at its Lake Giles Iron Project targeting Asian steel mills focused on producing high quality steel products, enhanced furnace efficiencies, reduced consumption of coking coal and improved environment emissions standards.

Macarthur’s Lake Giles Iron Project will aim to be very much at the fore of a new global iron ore future that values more sustainable steel products that are derived from responsible mining practices, with the highest focus on safety and with a commitment to respecting the environment and Indigenous interests. Macarthur is set to become ‘The Green Iron Ore Company’, and the Board and Management maintains commitment to driving those outcomes and delivering real value to our shareholders.”