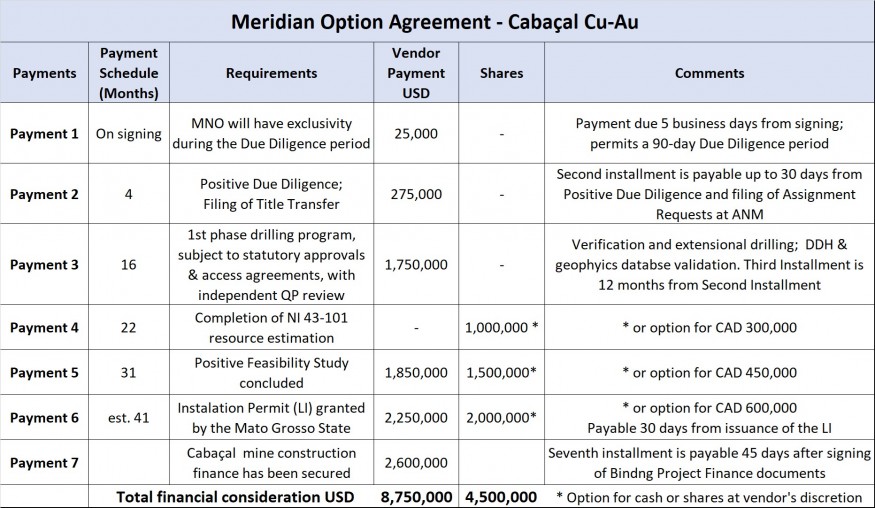

(“Meridian” or the “Company”) today announces that it has signed an option agreement (“the Agreement”) to acquire a 100% beneficial interest in the Cabaçal Copper-Gold Project (“Cabaçal”), in the state of Mato Grosso, Brazil, located 330km west of Cuiabá (Figure. 1), for a total consideration of USD 8.75 M and 4.5 M Meridian shares (Table 1) from two private Brazilian companies Prometálica Mineração Ltda and IMS Engenharia Mineral Ltda (together “the Vendors”). The payments in cash and shares are spread over approximately 39 months and are milestone based (Table 1). This is an arm’s length transaction.

Highlights of the Cabaçal project are:

- Cabaçal has an undeveloped Cu-Au mineralization zone extending from near surface to 175m depth, traced over 1.8 km in historical drilling, and open at depth and along strike:

- Historical mineralisation intersected by BP-M can be exceptionally thick;

- e.g. Diamond drill hole JUSPD075 21.0 m @ 0.59% Cu & 1.04 g/t Au;

- The Cabaçal project has an extensive database:

- 600 surface and underground diamond drill holes (“DDH”) totalling 70,000 m;

- 17,300 assay samples (stream sediments, soil, channel and drill core);

- 2,800 km line of aerial geophysics;

- 190 km of ground geophysics (magnetics, induced polarisation and electromagnetic);

- Cabaçal has additional targets for Cu-Au-Ag and Zn-Pb-Ag mineralization untested by drilling and defined by geophysical surveys and soil-stream geochemistry; and

- Exploration and mining tenure covers 18,460 Ha:

- Extends over a 30km strike length of the prospective Proterozoic greenstone sequence;

- Highly prospective for repeat VHMS mineralisation.

The Cabaçal Cu-Au deposit was discovered in 1983 by BP Minerals (“BP-M”), then acquired by Rio Tinto (at the time RTZ) as part their USD 4.3 B acquisition of BP Minerals in 1989. The project was acquired by the Vendors from Rio Tinto in 2005. Cabaçal has an historical inferred resource* of 21.7 Mt @ 0.6 % Cu & 0.6 g/t Au completed by Falcon Metais Ltda in 2009 (“Falcon”), as more particularly set out below.

* Note: The historic resource was completed by Falcon and presented to the Vendors in a report dated 22 April 2009. The Company has not treated this resource as a current mineral resource for purposes of National Instrument 43-101. Readers are cautioned that the historic resource is not considered to be current for purposes of NI 43-101. The historical resource was estimated via an Inverse Square Distance method, using data from 301 diamond drill holes. A uniform density of 2.7 was applied for tonnage calculation, using 3D solids modelled from 54 sections. A 0.20% Cu Equivalent % cut off grade was applied (CuEquiv % = Cu % + (0.51 * Au ppm); Metallurgical Recovery = 85% Cu, 65% Au; Au price US$ 845 / oz; Cu price US$ 4000 / ton). Given the amount of historic exploration data on the Cabaçal project the Company considers the historic resource to be relevant to understand the mineral potential of the Cabaçal project. However, as part of its due diligence review of the Cabaçal project the Company will seek to validate the historic resource. Historical resource numbers are rounded to 1 decimal place. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

The Cabaçal project is located in the Alto Jauru Belt, a historical centre of gold and base metal mining. The Cabaçal Cu-Au deposit was previously mined by BP-M/ RTZ as a shallow, selective high-grade underground operation in in the late 1980’s to early 1990’s. The main zone of massive to stockwork, stringer and disseminated Cu-Au sulphide mineralization was never mined. Cabaçal’s Cu-Au mineralisation remains open beyond ~175 meters below surface, and along strike. At the time of mine’s closure by RTZ the approximate price for Cu1 and Au2 during 1991 was USD 1.04 per lb & USD 365.0 per ounce, respectively. The mineral system extends over a strike of 1,800m and has been defined by over 400 historic diamond drill holes. It is shallow-dipping, making it an attractive target for open pit development.

Table 1: The schedule for the Agreements milestone payments are as follows:

Dr Adrian McArthur, CEO & President, states, “Cabaçal represents an outstanding opportunity for Meridian’s future. Having laid dormant in two small private companies for so long the Company looks forward to leverage off the historical exploration data of RTZ and BP Minerals, and quickly take Cabaçal’s drilled and mapped Cu-Au mineralization to a NI43-101 statement and then to a feasibility study through a targeted program of infill and confirmation drilling and metallurgical testwork. The extensive mineral system consists of a stacked series of shallow-dipping Cu-Au lenses – an ideal geometry for testing the open-pit development potential. Such deposits tend to occur in clusters, and the existing geophysical and geochemical surveys indicate clear targets in prospective stratigraphy along strike. Securing the 30km Cabaçal VMS trend opens up the potential of future resource development and exploration success.”

History, Geology, and Mineralization Model

The Cabaçal deposit is located in the SW Amazonian craton in Mato Grosso, an important gold-producing state. The deposit is hosted by in Proterozoic metavolcanic-sediment rocks of the Alto Jauru Greenstone Belt. The belt consists of an association of bimodal volcanic and sedimentary rocks (tholeiitc meta-basalts of the Mata Preta Formation, felsic volcanics of the Manuel Leme Formation, meta-sedimentary rocks of the Rancho Grande Formation, intruded by granites, tonalites, and gabbroic dykes).

The discovery of the Cabaçal Deposit has its origins in the 1980’s gold rush, during which local companies backed by BP International carried out extensive mapping, stream and soil geochemistry, and reconnaissance drilling. which lead to the discovery of the Cabaçal Deposit in 1983. The project operated as an underground mine producing 869,279t at 5g/t Au and 0.82% Cu over four years up to 1991. Regional exploration by RTZ and BP consisted of >600 drill holes (70,000 m of drilling), of which 406 holes were drilled at Cabaçal.

The deposit is considered to be deformed Cu-Au rich end member of the Volcanic Hosted Massive Sulphide (VHMS) deposit style. Globally, such deposits have been major global hosts of base metals, gold and silver. Deposits tend to form in districts of about 40 km in diameter, that may contain dozens of periodically spaced mineral centres, related to hydrothermal convection cells on the ocean floor. With tilting, deposits may now be at or below the present-day erosional surface. Whilst VHMS deposits are well known for their base metal production, notable examples exist of copper-gold and gold-only end members, including Mt Lyell (Cu-Au) and Henty (Au) of the Mt Read Volcanics (Tasmania, Australia), and LaRonde Penna deposit of the Doyon-Bousquet-mining camp (Quebec, Canada).

The immediate host rocks consist of foliated cherts and volcaniclastic rocks, with hydrothermal overprints of variable sericite, biotite, and chlorite alteration. Cu-Au mineralization has been traced over 1.8km in the mine environment, although much of the drilling is focussed over a 750m sector. Mineralization dips moderately, presenting a good geometry for potential open pit development. As part of the due diligence program, the Company will engage SRK to undertake a detailed audit of the database and past foreign resource estimates, to scope the program requirements over the next 12 months. Current interpretations show that the targeted mineralization forms a series of stacked sheets (Figure 2), which individually can have widths of ~ 10 – 40 m and have been traced ~250-500 m down-dip. The due diligence program will assess the Vendors own recommendations to focus a 7200 m drilling program over a 1km strike length of the central Cabaçal Cu-Au trend. Comparative chemical and geological analysis by the Vendors twinning a RTZ DDH returned a reliable comparison (Figure 3). The historical mining activity confirms that Cabaçal will be amenable to conventional metallurgical processing for VHMS type mineralization.

The Cabaçal project tenure covers a 30km strike length of the prospective Proterozoic greenstone belt, and comprises:

- The Cabaçal Mining Lease Application (4,028 Ha; 866292/2004)

- The Santa Helena Mining Lease (875 Ha; 861956/1980)

- Three exploration licenses:

- 867407/2008 (9,813 Ha)

- 866002/2016 (2,566 Ha)

- 866455/2016 (1,180 Ha)

Polymetallic base metal mineralization was more recently exploited at Santa Helena, but the mine is now closed and rehabilitated. Prioritized satellite targets have been defined through a combination of geophysical and geochemical methods, with the VTEM survey in particular highlighting extensions of the prospective stratigraphic horizon. The Vendors have recommended a program of exploratory drilling, to test NE and SW extensions to the Cabaçal trend, and satellite targets at the Fazenda São Paulo Prospect, Sucuri Prospect, and Fazenda Álamo Prospect.