PALL has traded sideways of late, reflecting a horizontal consolidation in the PGM space. This is mainly the result of uncertainty surrounding the global automotive sector.

Interestingly, speculators and ETF investors have expressed renewed buying interest for palladium since late June, which could be viewed as a positive shift in sentiment.

Although the global automotive sector is in a precarious state, a recovery could take place in the second half on stronger economic conditions.

This would stimulate further spec/ETF buying, pushing palladium prices higher.

Against this, we expect PALL to strengthen in the months ahead, having a max target of $260/share for Q3.

Thesis

Welcome to Orchid’s Palladium Weekly report, in which we discuss palladium prices through the lenses of the Aberdeen Standard Physical Palladium Shares ETF (NYSEARCA:PALL).

PALL has traded sideways of late, reflecting a horizontal consolidation in the PGM space.

Palladium’s fundamentals are less tight than expected due to the COVID-19 shock, which is reflected in the weak price action.

Interestingly, speculators and ETF investors have expressed renewed buying interest for palladium since late June, which could be viewed as a positive shift in sentiment.

Although the global automotive sector is in a precarious state, a recovery could take place in the second half on stronger economic conditions. This would stimulate spec/ETF buying, pushing palladium prices higher.

Against this, we expect PALL to strengthen in the months ahead, having a max target of $260/share for Q3.

Source: Trading View, Orchid Research

About PALL

For investors seeking exposure to the fluctuations of palladium prices, PALL is an interesting investment vehicle because it seeks to track spot palladium prices by physically holding palladium bars, which are located in JPM vaults in London and Zurich. The vaults are inspected twice a year, including once randomly.

The Fund summary is as follows:

PALL seeks to reflect the performance of the price of physical palladium, less the Trust’s expenses.

Its expense ratio is 0.60%. In other words, a long position in PALL of $10,000 held over 12 months would cost the investor $60.

Liquidity conditions are poorer than that for platinum. PALL shows an average daily volume of $3 million and an average spread (over the past two months) of 0.33%.

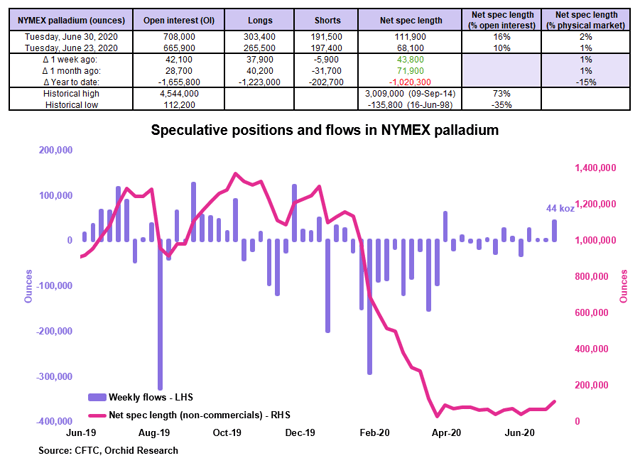

Speculative positioning

Source: CFTC, Orchid Research

The speculative community raised its net long position in NYMEX palladium by 44 koz in the week to June 30, according to the CFTC. This was the largest weekly increase in the net spec length since March.

As we warned in a previous report, palladium’s spec positioning was unlikely to deteriorate further because the backwardation in the NYMEX palladium curve prevents speculators from building aggressive short positions.

We expect more spec buying for NYMEX palladium by year-end, reflecting a shift in focus from the weak fundamental backdrop in 2020 due to the COVID-19 shock to tighter fundamental dynamics next year.

It is too early to ascertain that a positive change in sentiment has emerged yet, especially after the weaker-than-expected auto sales in China for June.

Implications for PALL: Palladium’s spec positioning is extremely light, meaning that there is plenty of room for additional fresh buying in the months ahead. This is positive for the NYMEX palladium price and thus PALL.

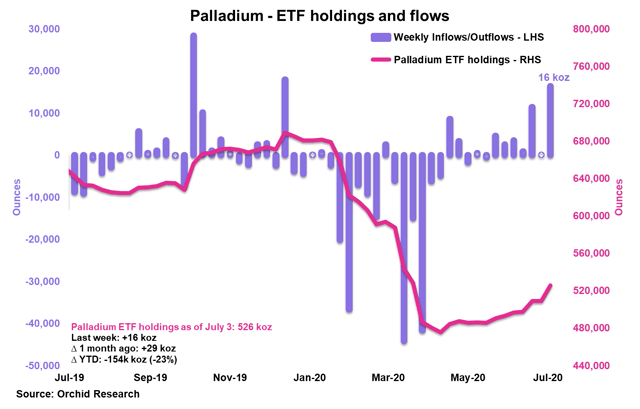

Investment positioning

Source: Orchid Research

ETF investors bought 16 koz of palladium in the week to July 3, according to our estimates. This was the largest weekly increase in palladium ETF holdings since December 2019.

It seems that ETF investor sentiment toward palladium is shifting positively like it is the case in the platinum market.

If these ETF inflows are sustained, they will become impactful once refined market conditions tighten on the back of a rebound in autocatalyst demand.

Implications for PALL: The renewed buying interest among ETF investors is encouraging for PALL.

Closing thoughts

PALL has traded sideways of late, reflecting a horizontal consolidation in the PGM space.

Palladium’s fundamentals are less tight than expected at the start of the year due to the COVID-19 shock, which is reflected in the weak price action. This is primarily the result of the contraction in autocatalyst demand for PGMs.

However, it seems that speculators and ETF investors have expressed renewed buying interest for palladium since late June, which could reflect a positive change in sentiment.

Since we think that a recovery in the auto sector is likely in the second half of the year, thanks to stronger economic conditions, we expect the financial community to turn more bullish on palladium. This should drive palladium prices higher.

Against this, we expect PALL to gain strength in the months ahead, setting a max target for Q3 at $260 per share.