This year Sierra Metals made great progress: two lagging mines were converted into free cash flow engines.

There were two factors standing behind this transition: higher throughput and lower costs.

It is not the end of story: before 2024, the company plans to increase throughput at Yauricocha and Bolivar.

In the final part of the article, I am trying to prove that Sierra shares are significantly undervalued today.

Sierra Metals (SMTS) is a medium base metals producer, operating the following three mines:

- Yauricocha (located in Peru) – it is a flagship operation focused mainly on zinc and copper

- Bolivar – a copper producer located in Mexico

- Cusi – a small silver operation in Mexico

In the past, the Yauricocha mine was the main growth engine for Sierra but this year the company made big progress converting the remaining two mines into cash generators. In this article, I discuss this impressive turnaround.

Production profile

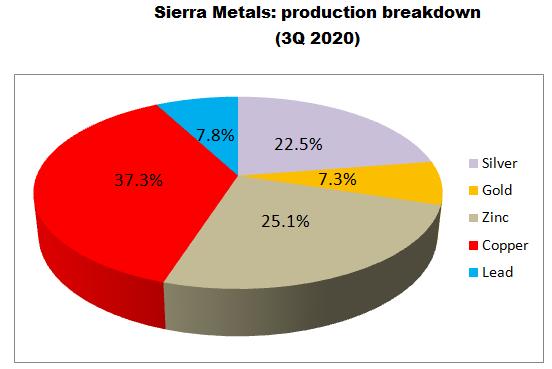

As mentioned above, Sierra is mainly a base metals producer where copper and zinc account for 62.4% of total production (3Q 2020). Apart from that, the company produces silver (22.5% of total production) and gold (7.3%) plus a marginal amount of lead (7.8%):

Source: Simple Digressions

Business idea

The company’s strategy is very simple – process as much of the ore as possible and do it at the lowest cost possible. Sounds easy but I could name a number of mining companies that had a similar strategy and… failed. Sierra is different – they really do what they promised to investors. Let me start from a very important measure called “throughput.”

Throughput

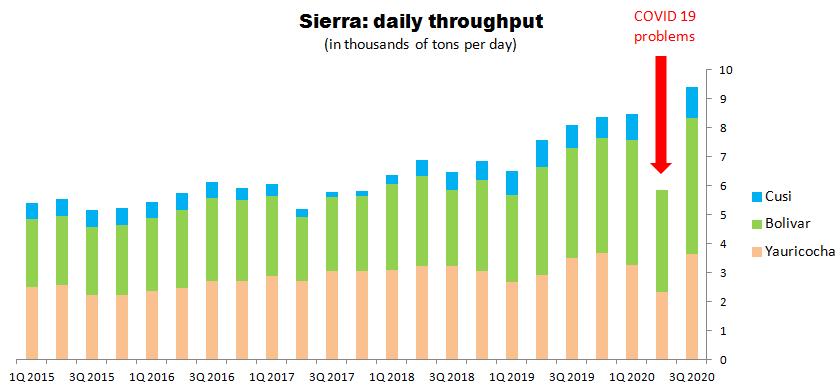

For those unfamiliar with mining terms – throughput measures how much of the ore the mine processes every day. Generally, the higher the throughput, the more metals the mine is able to deliver. Here is the chart illustrating this measure starting from the beginning of 2015:

Source: Simple Digressions

I guess it is easy to spot a steady growth of the company’s consolidated throughput from 5.4 thousand tons of ore a day in 1Q 2015 to 9.4 thousand in 3Q 2020 (excluding 2Q 2020 when Sierra, as many other miners, was negatively affected by the COVID-19 pandemic – the red arrow). Another important fact – very soon we should see even higher throughput at Bolivar and Yauricocha:

- Bolivar – this year Sierra successfully completed the first stage of an optimization program at this Mexican operation. For example, in 3Q 2020, the mill capacity hit 4.7 thousand tons of ore per day. However, a few weeks ago, the company announced its plan to increase throughput twofold (to 10 thousand tons a day in 2024)

- Yauricocha – now this flagship property has a nominal capacity of 3.15 thousand tons of ore a day but next year the mill will be upgraded to 3.6 thousand tons a day.

Note: When talking about throughput, I mean a nominal capacity. However, it happens that from time to time a mill is able to surpass its nominal capacity. For example, in 3Q 2020, the Yauricocha mill processed 3.6 thousand tons of ore a day on average, reaching a level projected for 2021.

Costs of production

I do not want to go too deeply into this matter but there are two main methods a resource company reports its costs of production:

- A by-product method – here a company reports the cost per ounce/pound of a main metal produced (in this case, the main metal accounts for at least 80% of total production).

- A co-product method – in this case, the costs are reported per ounce/pound of the so-called equivalent of a metal produced (what is more, it is up to a mining company which metal it chooses to measure costs of production; in most cases, a main metal is chosen as a cost driver).

Sierra has chosen the second approach, the best one for multi-metal producers where no metal accounts for more than 80% of total production.

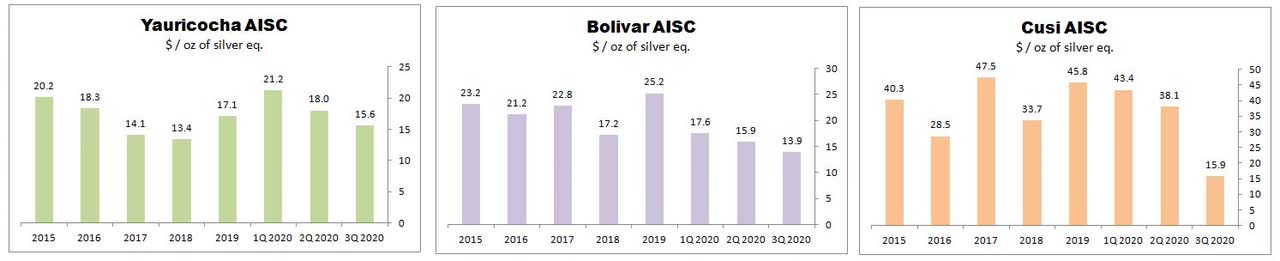

Now the main point – due to the fact that metal prices fluctuate from quarter to quarter, this method is quite tricky (i.e. the costs reported in a period A cannot be compared to the costs incurred in a period B). To eliminate this problem, I have modified this approach using fixed metal prices when calculating costs of production. And here is the final result – the charts below depict an all-in sustaining cost of production (AISC) calculated for all three mines using a fixed price of silver (i.e. I have chosen silver as a main metal):

Source: Simple Digressions

The conclusions are as follows:

- In the past, Sierra had only one medium-cost producer – it was the Yauricocha mine. The other two operations were cash flow negative for most of the time.

- This year the company converted the Bolivar mine from a high-cost producer to a low-cost one.

- In 3Q 2020. the Cusi mine produced its metals at an AISC of $15.9 per ounce of silver equivalent, the lowest cost ever. However, I think it is too early to trumpet the final turnaround there. History teaches that Cusi is not an easy operation so, let us wait and see what happens next.

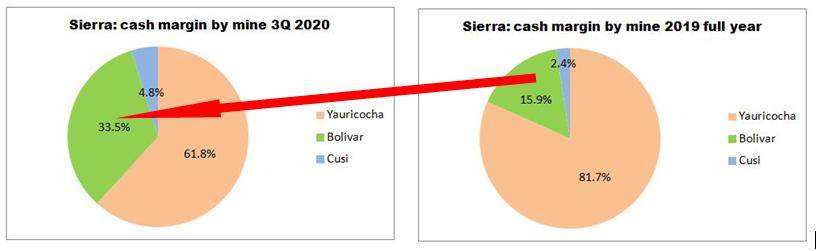

Summarizing – due to a big improvement at Bolivar and Cusi, this year Sierra managed to cut its consolidated all-in sustaining cost of production to $15.1 per ounce of silver equivalent (from $20.5 per ounce in 2019). What is more, due to upgrading the Bolivar mill, this mine became the second growth engine for the company, delivering 33.5% of total cash margin reported by the company – the chart below illustrates this fundamental shift:

Source: Simple Digressions

Finally, it seems that the Cusi mine is on the right track to join Bolivar and become the third pillar of strength to Sierra.

3Q 2020 financial results

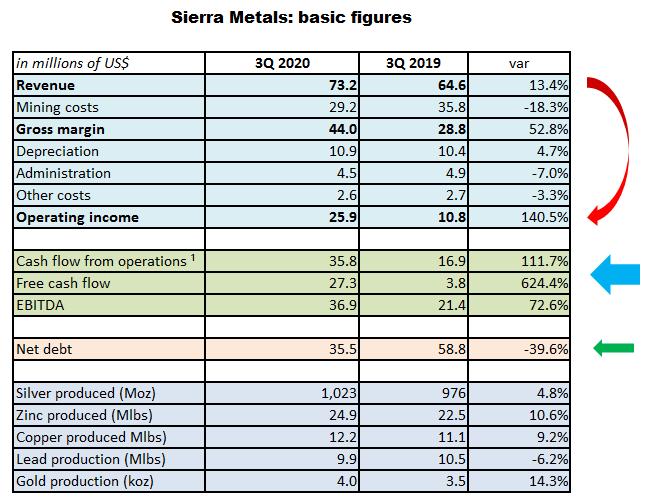

The above-discussed factors had a very positive impact on Sierra results reported in 3Q 2020. Here is the appropriate table:

Source: Simple Digressions (based on the company’s data)

Comment:

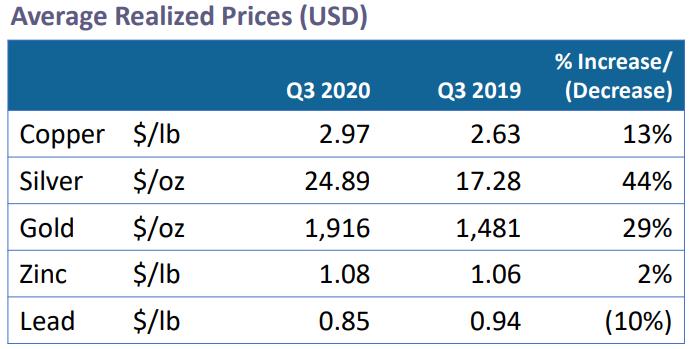

- Sales went up 13.4% driven by higher production (for example due to higher throughput) and stronger metal prices:

Source: Sierra

Note: Treatment and refining charges had a negative impact on sales (driving them down). To compare: In 3Q 2020, these charges amounted to $14.7M vs. $9.8M in 3Q 2019. Unfortunately, these figures are not disclosed in the statement of operations published by the company (the chart above discloses net sales only).

- However, due to cost cuttings, the gross margin and operating income went up by 52.8% and 140.5%, respectively (look at the red arrow).

- It is obvious that lower costs had also a positive impact on cash flow figures (the blue arrow). For example, free cash flow went up from $3.8M in 3Q 2019 to $27.3M in 3Q 2020

- Finally, the company’s net debt fell to $35.5M, making Sierra almost a debt-free company.

How much is it worth?

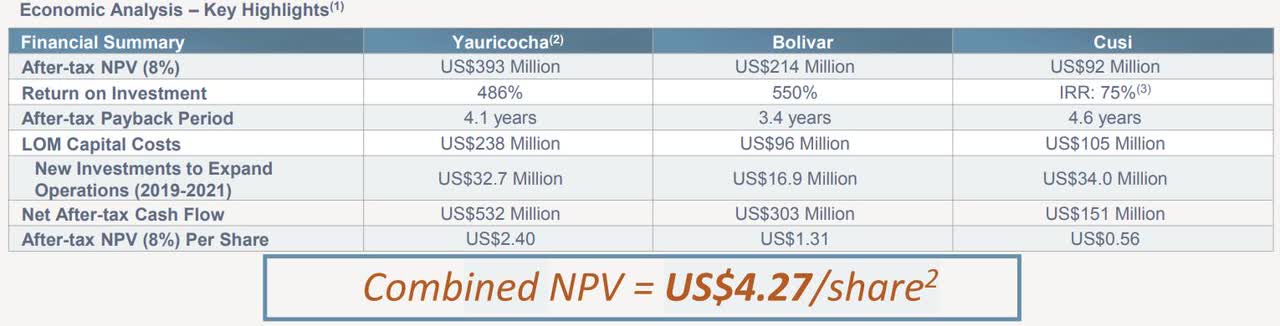

Last year I published an article on Sierra and attached this graph:

Source: Sierra

Note: Financial and operating statistics represent 100% ownership of Yauricocha. Assuming 82% ownership, NPV/share at Yauricocha is US$1.97 with a combined NPV of US$3.84.

Then I presented my own discounted cash flow valuation model, arriving at the final intrinsic value of Sierra shares of$2.48.

However, since that time a few things have changed:

- Metal prices went strongly up (for example, a price of silver went up from $18.7 per ounce assumed in the model to $24.3 per ounce today).

- The company made significant progress at Cusi and Bolivar; what is more, it plans to increase throughput at Bolivar to 10 thousand tons of ore a day (this factor was not included into my financial model).

Now, these factors would have a huge, positive impact on the company’s value if plotted into a new, updated model. In other words, most probably the intrinsic value of Sierra shares would have been significantly higher than $2.48 reported last year. However, today these shares are trading at approximately $2.0 a share so they are strongly undervalued.

Risk factor

Share liquidity

Sierra shares are listed on the American Stock Exchange (AMEX) under the ticker SMTS. This year the average daily trading volume for these shares was 301 thousand. It is not a high figure so Sierra shares are pretty illiquid.

Summary

This year Sierra made great progress, converting two lagging mines into cash-generating operations. As a result, now the company is well-equipped for an ongoing bull market in base and precious metals, owning three decent mines (though, as discussed above, I am still a bit skeptical about Cusi).

What is more, it looks like it is not the end of story. For example, next year Sierra plans to increase throughput at its flagship property, Yauricocha in Peru and in 2024 the Bolivar mine in Mexico should double its capacity.

In the final part of this report, I am putting a thesis that Sierra shares are undervalued today. Although I do not present a detailed valuation model (it is reserved for my subscribers), it seems that the intrinsic value of these share is well above the current market price of $2.0.

Final note

Did you like this article? If your answer is “Yes,” please visit my Marketplace service, Unorthodox Mining Investing where I run a portfolio of up to 10 mining picks, discuss new investment ideas, and provide subscribers with a medium-term outlook on a few financial markets (particularly the base/precious metals market).

Disclosure: I am/we are long CEF, SSRM, SAND, DPMLF, DNGDF, TRQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Like this article